Overview

The Investment Memo project was designed to accelerate lead preparation for transaction associates and streamline acquisition decision-making for C-suite executives at Teamshares, enabling smarter acquisitions and scaling investment impact.

Streamline Information Extraction: Automate data extraction to reduce manual labor, minimize errors, and increase efficiency.

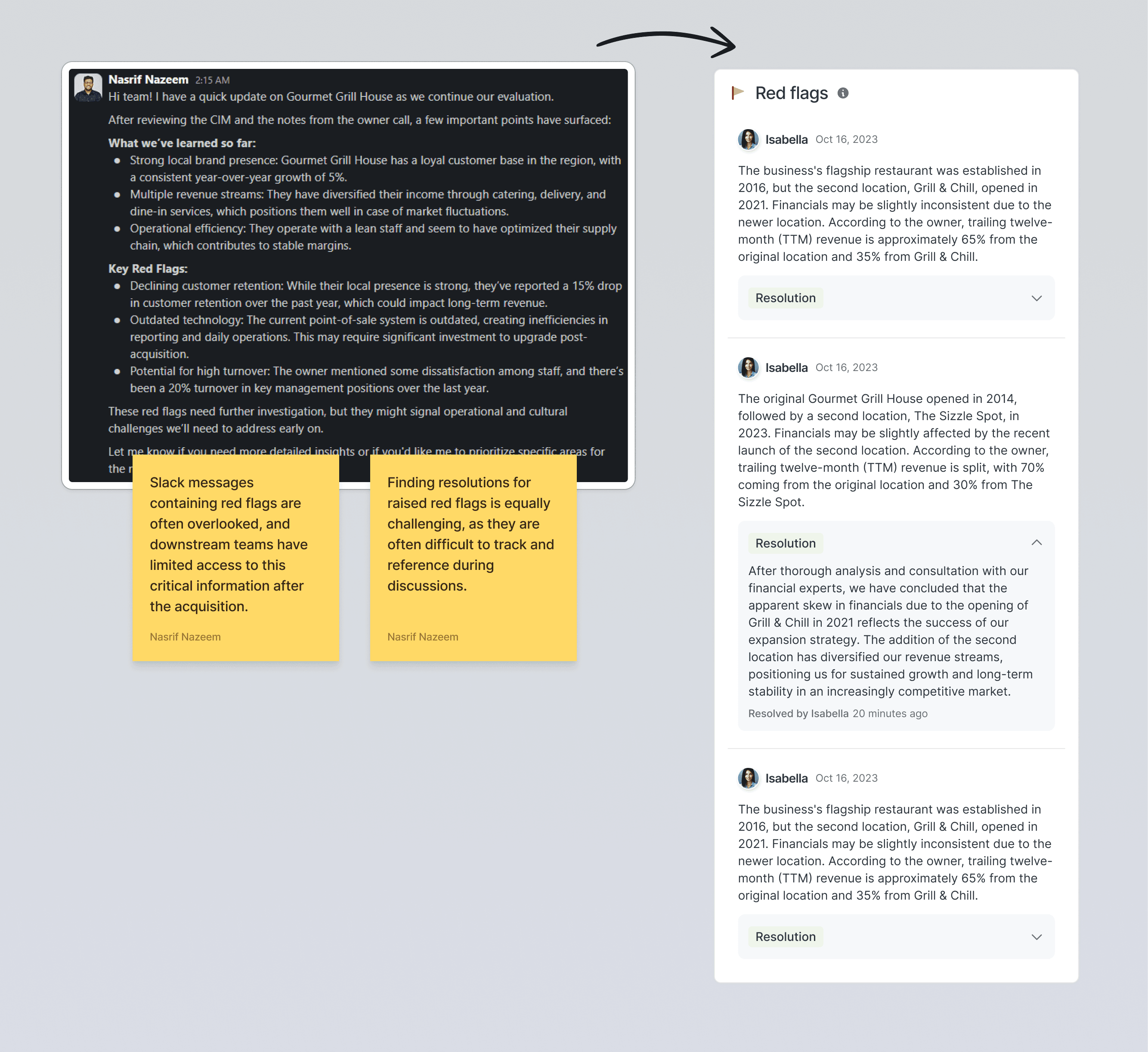

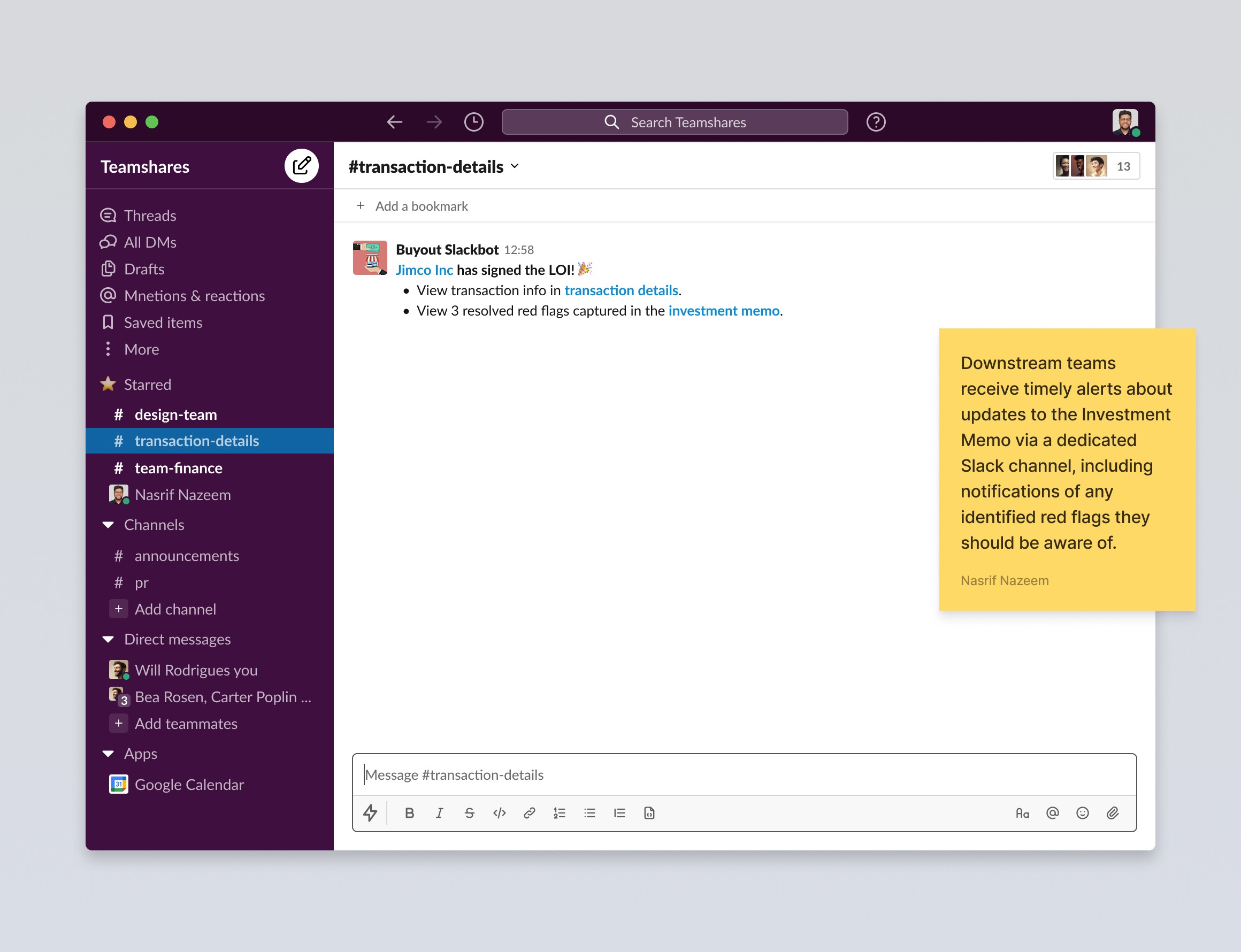

Capture Red Flags and Risks: Equip users to flag potential risks early and monitor key issues throughout the acquisition process.

Enhance Decision-Making: Present critical insights in a structured, accessible format to facilitate faster, more informed decisions.

Establish a Source of Truth: Create a centralized, authoritative document that serves as a reliable reference for all SMB acquisition decisions.

Problem: Lack of structure and clarity in investment meetings

At Teamshares, we acquire small businesses across the U.S. and transition them to employee ownership.

In this workflow, transaction associates review qualified leads in our system, capture key business details, and prepare presentations for the Investment Committee to evaluate potential acquisitions.

However, this process was chaotic and inconsistent, leading the CEO to request a more structured approach to Investment Committee meetings.

Understanding the problem

To understand what the CEO meant by ‘structure’, the PM and I decided to experience the problem firsthand.

We joining the daily Investment Committee (IC) meeting and took notes on how leads were presented, discussed, and decided by the IC members.

We also spoke with 3 transaction associates and 2 IC members to hear directly from them to uncover their experiences, frustrations, and where structure was most needed.

Pain Points

👩💼 Transaction associates | 👨💼 Investment Committee Members |

|---|---|

No standardized format for presenting deals during IC meetings. | Difficult to quickly grasp deal context when transaction associates present. |

Manual effort gathering deal data across different sources. | Too much time is spent understanding the basics of the business before deal discussion. |

Tight turn-around before daily IC meetings created stress and last-minute updates. | Context switching between different deals caused cognitive overload. |

Early direction to summarize details

We explored ways to simplify how IC members reviewed leads. We designed a summary view that surfaced what we thought were the most important details all in one place.

Reframing the problem

After realizing that the summary tab wasn’t enough, we stepped backed and asked ourselves what structure really needed to be.

How might we help transaction associates synthesize and communicate deal intelligence clearly and consistently?

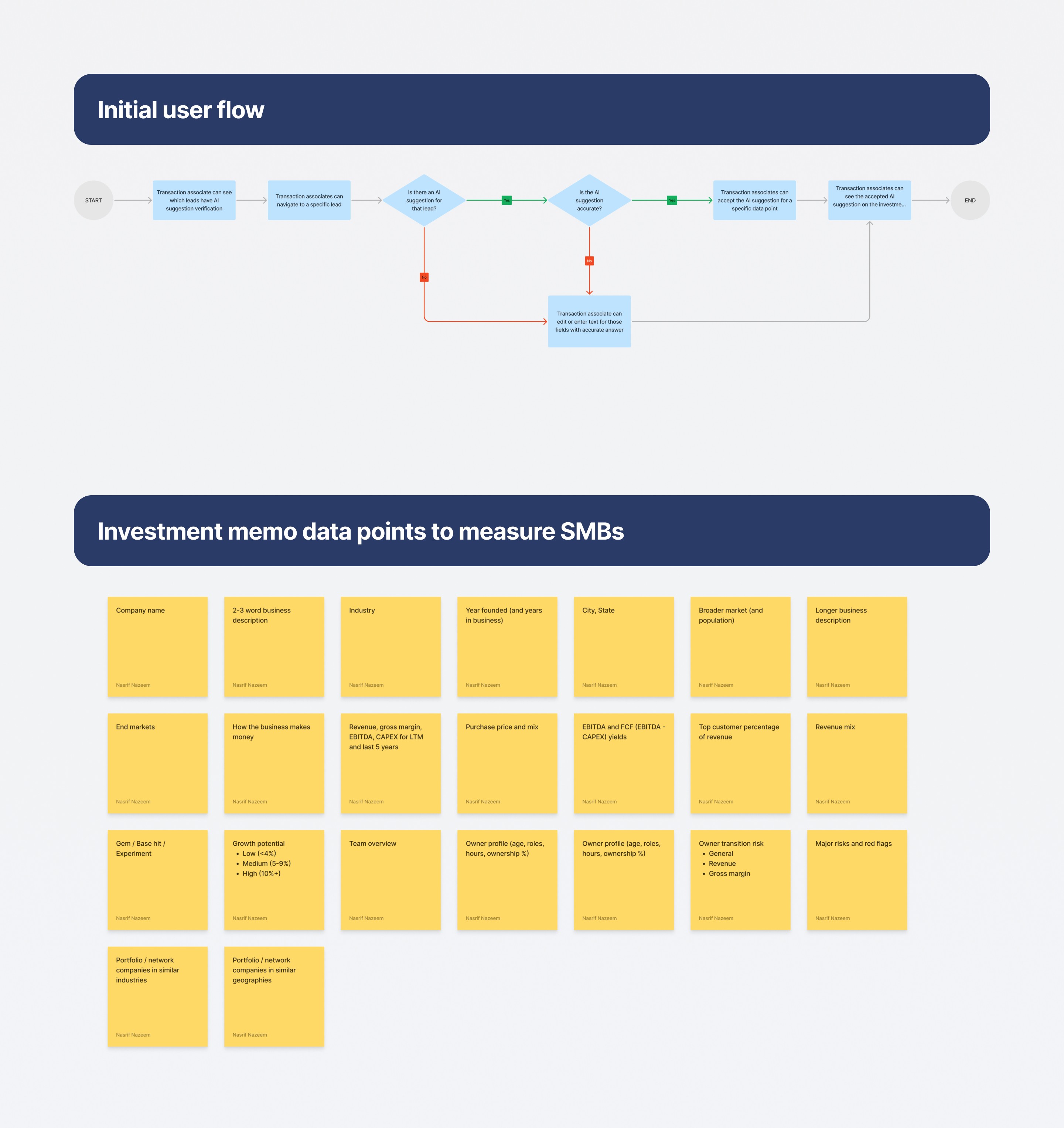

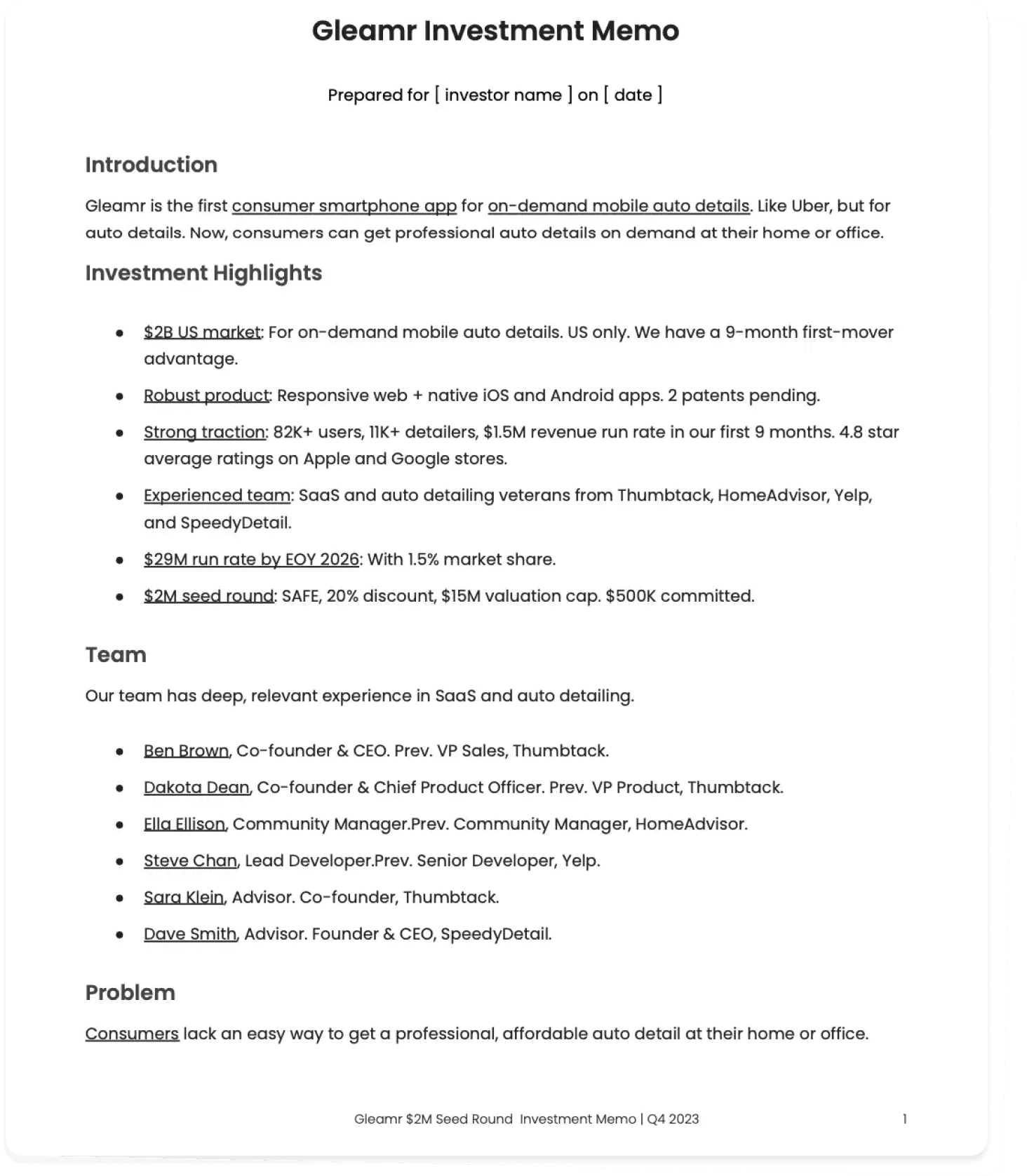

We drew inspiration from how investors and private equity firms use structured investment memos to frame their thinking and communicate rationale.

This became our north star to make IC meetings faster, more focused, and backed by context that everyone could trust.

Collaborating with engineering

Early alignment: Partnered with engineers early to understand what data the AI could reliably extract and what needed manual input.

Iterating together: Co-designed workflows and edge cases (e.g., missing data, validation errors) directly in Figma and during our syncs.

Design handoff: Shared annotated Figma files and supported launch to ensure visual and interaction fidelity.

Design QA: Conducted QA on staging builds to validate design and functionality before release to ensure the production UI matched design intent.

Design Explorations

Design Solution

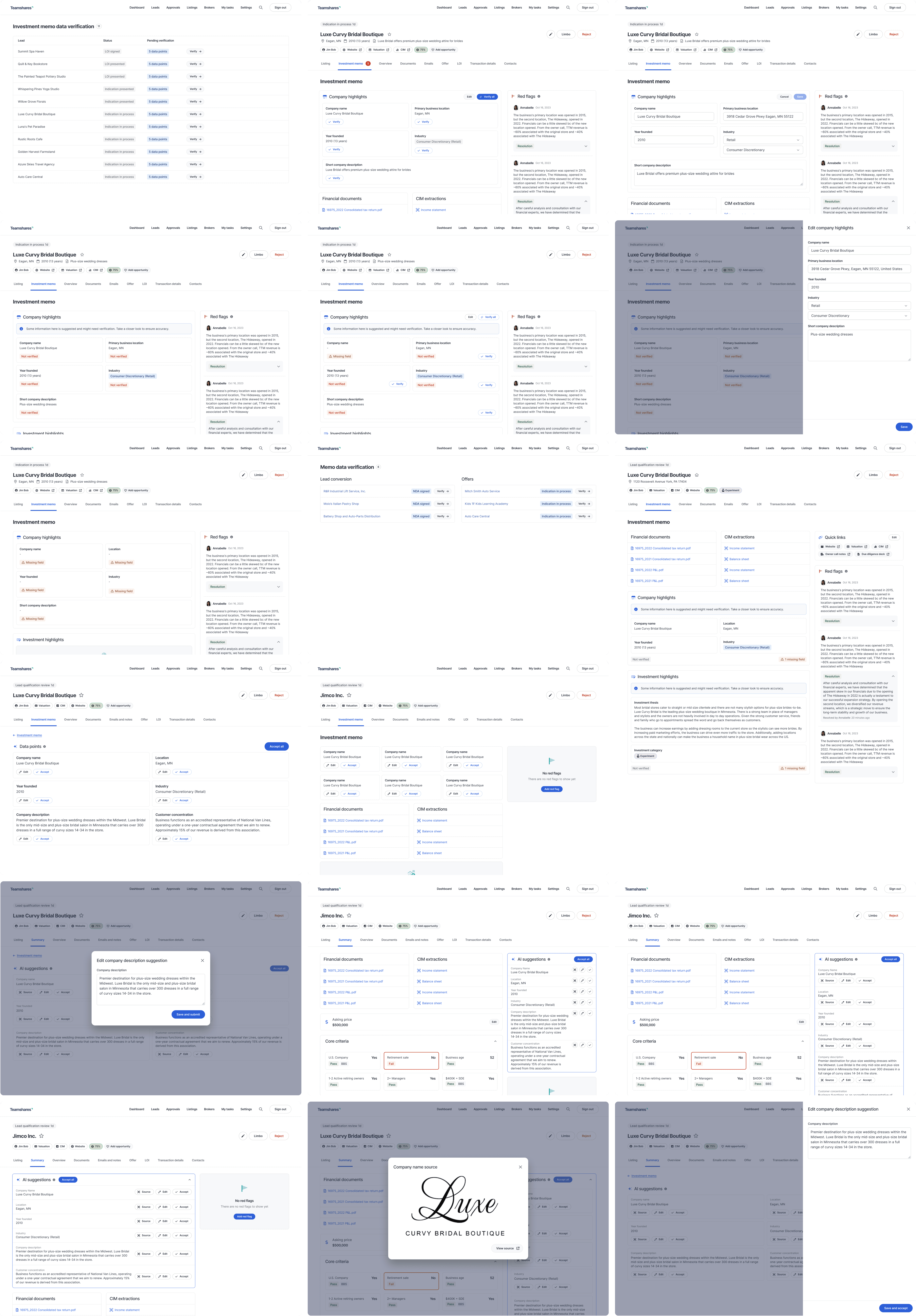

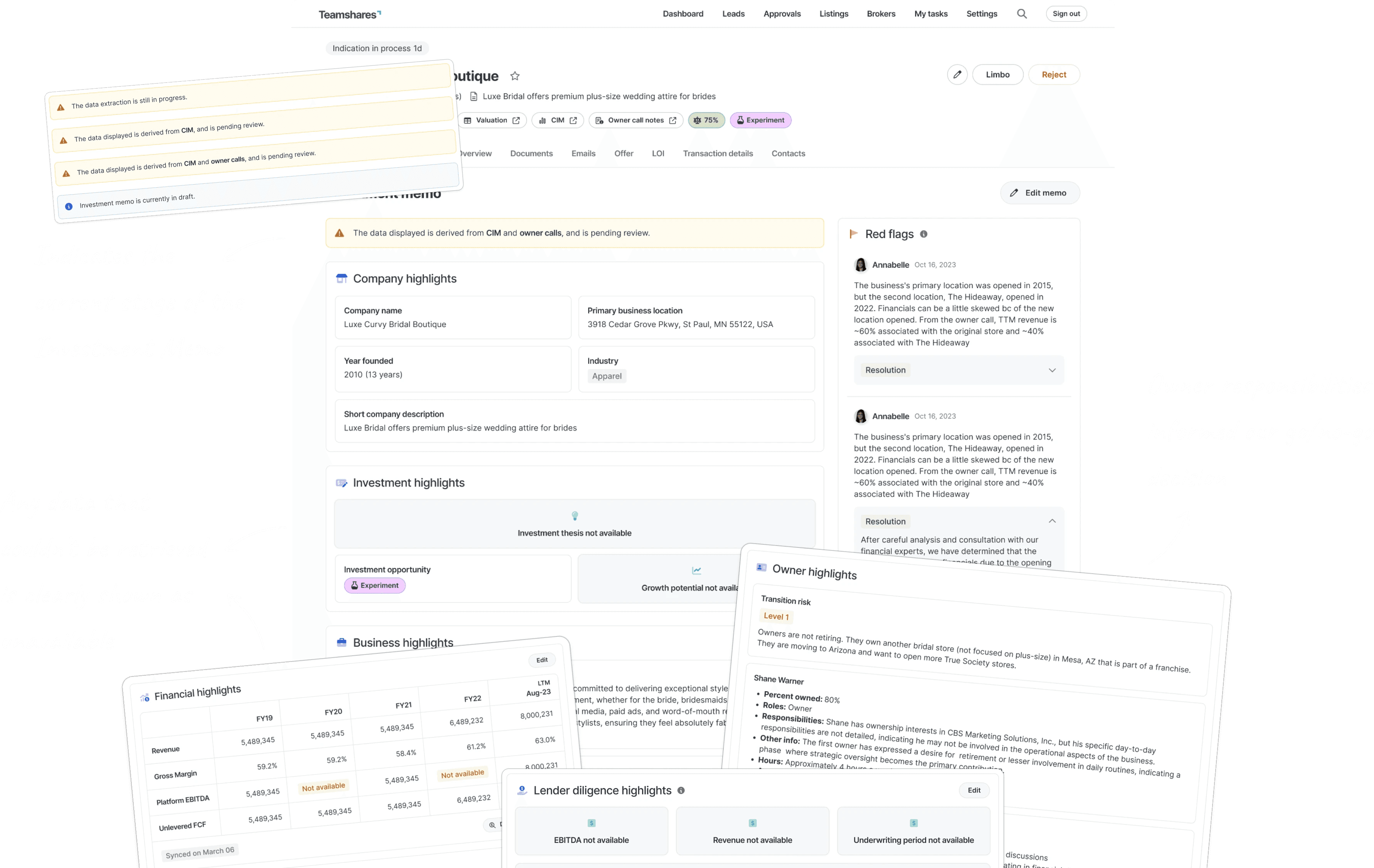

I implemented key enhancements to improve the summary tab's functionality and usability. The result was the Investment Memo.

AI-assisted preparation: We integrated AI into the workflow to auto-populate the key details to save time for transaction associates.

Human context & flexibility: Associates need to be able to review, refine, and add qualitative insights to add additional context.

Living, structured document: This memo has a consistent format that evolves as new information is added which keeps the IC aligned and discussions focused.

Outcomes

Reduced prep time by 33%, giving Associates more time to focus on high-value analysis.

IC meetings could review 30–40% more leads in the same time.

Leadership and associates finally aligned around a shared, structured source of truth.